does td ameritrade provide tax documents

Does TD Ameritrade provide tax documents. How do I get my 1099 from TD Ameritrade.

Fill Free Fillable Td Ameritrade Pdf Forms

Documents cannot be transferred from td ameritrade to turbo tax.

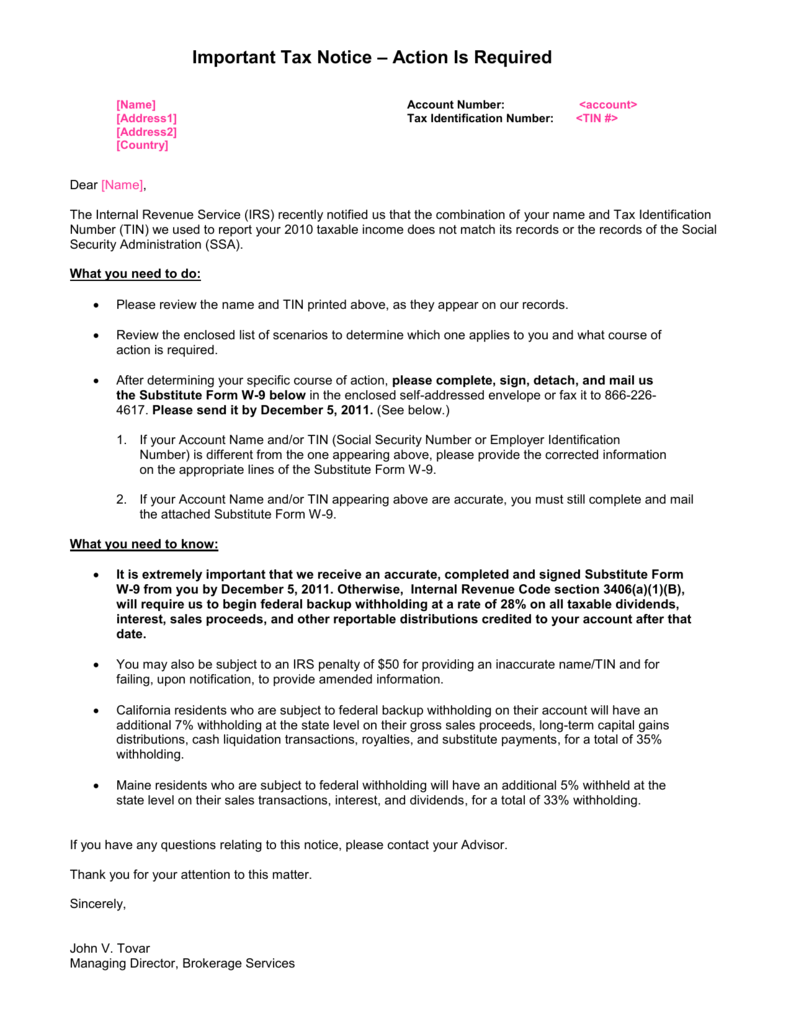

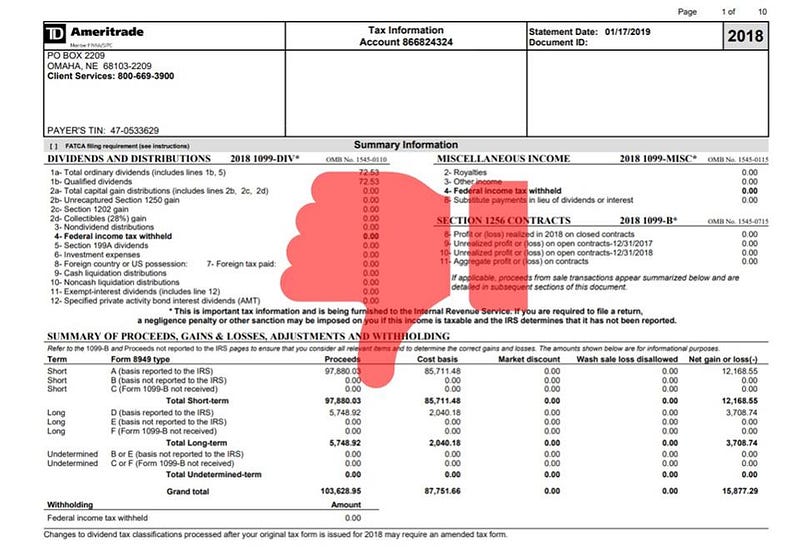

. Tracking your cost-basis To figure out your gainloss you need to know the original value of the asset or cost basis including adjustments such as. 1099-INT forms are only sent out if the interest earned is at least 10. 200902152D is licensed by the Monetary Authority of Singapore and does not provide tax legal or investment advice or recommendations.

IRS and Tax Forms. TD Ameritrade Singapore Pte. Get in touch Call or visit a branch Call us.

175 Branches Nationwide Go. For my non-qualified joint account I will need a 1099 from Ameriprise and TD AmeritradeHere is what we know. TD Ameritrade Inc member FINRASIPCNFA.

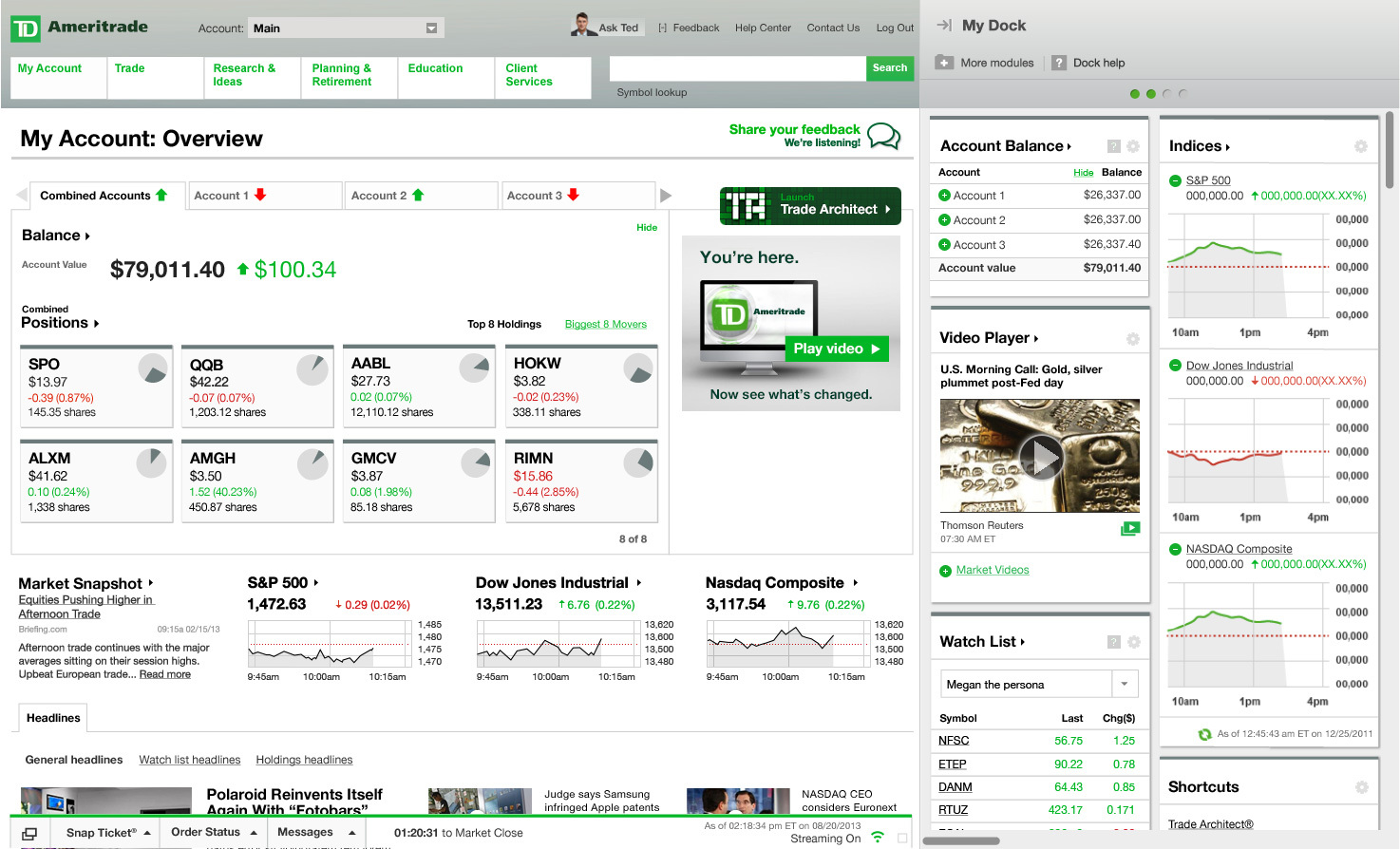

TD Ameritrade stores up to seven years of tax documents in your account and you can access these materials 24 hours a day. At TD Ameritrade Institutional we realize. Get all of your important tax filing forms all in one convenient place.

TD Ameritrade does not provide any tax legal or investment advice or recommendations. I can assure you my credentials are correct as I have no issue. Holding period requirements that must be met to be eligible for this lower tax rate.

Does TD Ameritrade provide tax documents. Get the Answers You Need Online. TD Ameritrade stores up to seven years of tax documents in your account and you can access these materials 24 hours a day.

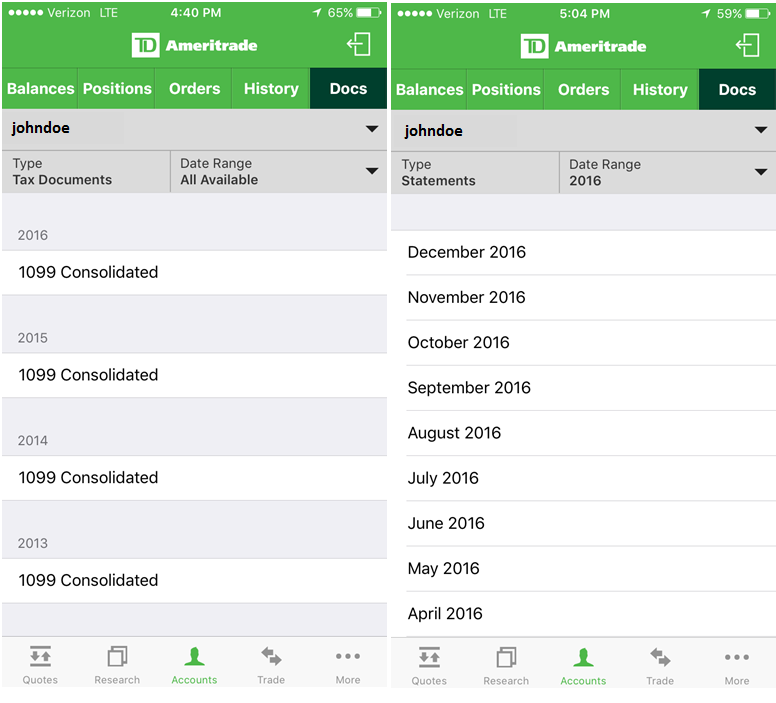

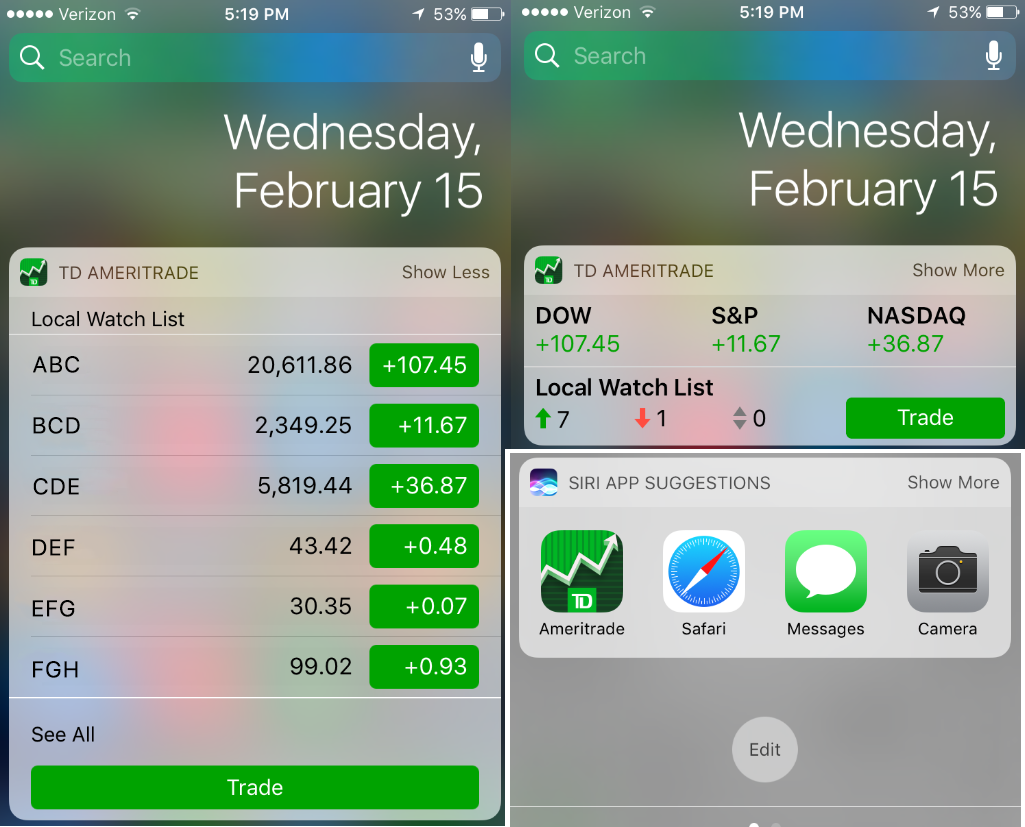

TD Ameritrade does not provide tax advice. The TD Ameritrade Mobile app now has up to 7 years of tax documents and 10 years of statements available from your iOS or Android device. TD Ameritrade does not provide tax advice.

TD Ameritrade will report a dividend as qualified if it has been paid by a US. This section is very useful for information about reportable transactions tax documents availability tax reporting questions and RMD calculations just to name a few. Ad Tax Day 2021 is Coming Soon.

Stop blaming it on amertrade or our credentials. TD Ameritrade is not responsible for payment reallocations that result in the issue of a corrected Consolidated Form 1099 and will not be held liable for any fees incurred for the refiling of a tax. The following may be excluded from the plan.

TD Ameritrade does not provide this form. To speak with a Tax Services Representative call 800-669-3900 Monday through Friday from 9 am. Get the Answers You Need Online.

You should have received your 1099 and 1098 forms. Or qualified foreign corporation. Reports reclassified income not captured on Consolidated 1099 forms to be issued in mid-February 2017 that was reported to TD Ameritrade between 292016 and.

TD Ameritrade clients can sign up for alerts via text and push notification when their tax documents are ready to view. You may wish to consult with a professional regarding your specific circumstances. Ad Increased Volatility has Increased Questions.

Actually yesif were talking about tax document alerts. Ad Increased Volatility has Increased Questions. Your tax forms are mailed by February 1 st.

Retrieve your tax documents or. We suggest that you seek the advice of a tax advisor with regard to your personal circumstances.

How To Read Your Brokerage 1099 Tax Form Youtube

Get Real Time Tax Document Alerts Ticker Tape

Importing From A Csv File Td Ameritrade Tradelog Software

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Td Ameritrade Launches Enhanced Web Experience For Retail Investors Business Wire

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

Td Ameritrade Launches Tax Loss Harvesting Tool For Investors Business Wire

Find Your 1099 On Td Ameritrade Website Tutorial Youtube

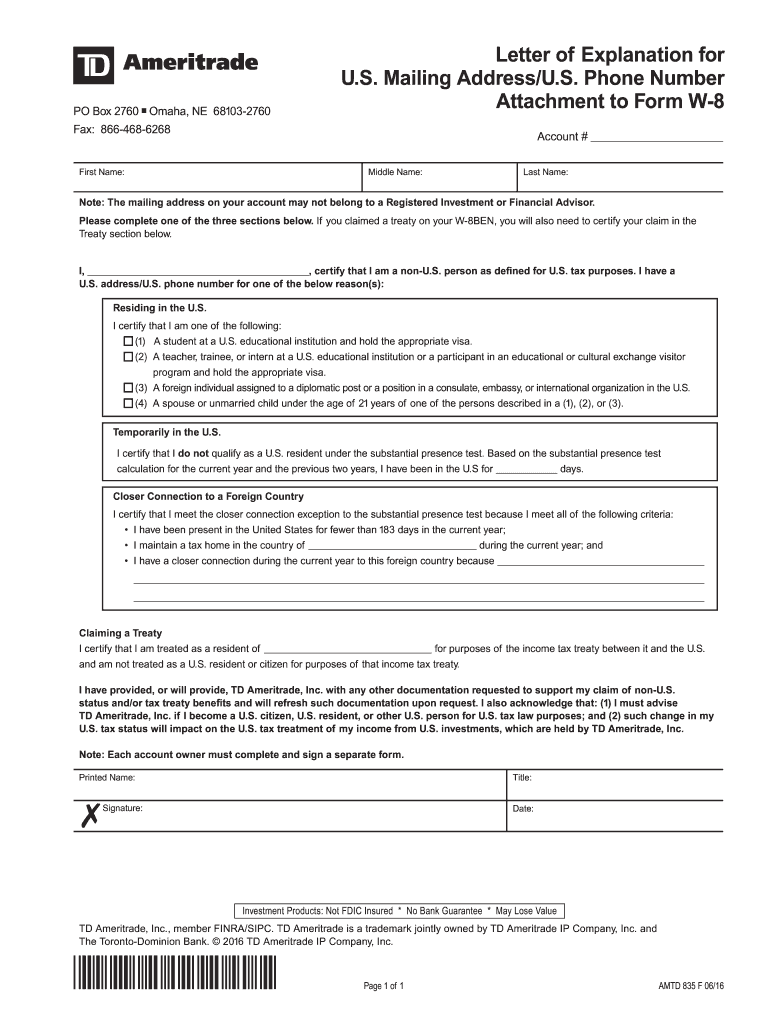

Fill Free Fillable Td Ameritrade Pdf Forms

Logo Td Ameritrade Institutional

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

Tax Season And More Made Simpler With The Td Amerit Ticker Tape

Irs Form W 8ben Td Ameritrade 2020 2022 Fill And Sign Printable Template Online Us Legal Forms